Shipbuilder with massive exposure to China lending and FX Risk

- Mar 9, 2019

- 4 min read

YangZiJiang(YZJ) Holdings // SGX:BS6 Current Price : S$1.39 18 Month Target : S$0.50

Background

Yangzijiang Shipbuilding is a large group with shipbuilding and offshore engineering as its core business and with four additional segments: financial investment, metal trading, real estate and shipping combined ship-leasing. The financial investment segment is the next largest segment after it’s core business and contributes a significant portion of its net profits.

FY18 performance

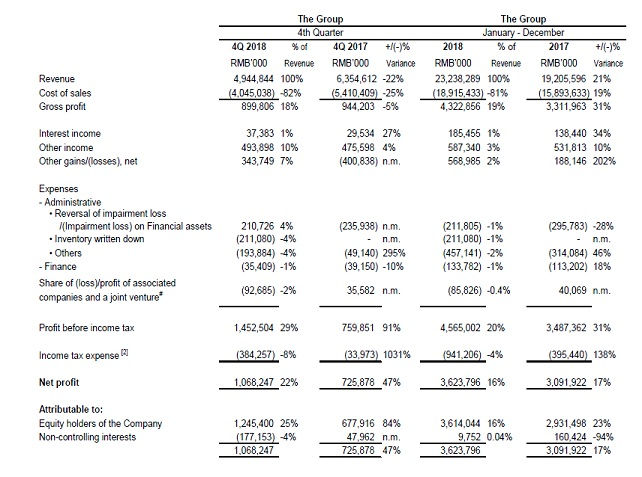

The Company has recently announced it’s FY18 revenue at 23.2 billion yuan, up 21 per cent on higher volume of shipbuilding activities, higher trading volume, higher revenue from shipping logistics, chartering and ship design services. The Group also delivered 46 vessels in 2018, versus 33 in 2017.

Total earnings per share was 91.34 RMB cents in 2018, up from 75.59 RMB cents in 2017.

YZJ's outstanding order book stood at US$3.9 billion for 113 vessels as at end 2018.

YZJ have also commented that despite the uncertainties associated with global economic growth and the trade tensions between US and China, research suggests some improvement in the fundamentals in the shipping and shipbuilding market in 2019. While global demand for container shipping is expected to remain stable and demand for seaborne dry bulk trade to grow at a faster pace in 2019, the fleet growth for both container ships and dry bulkers is expected to slow down in 2019 compared to 2018.

Our key takeaways and outlook

Balance sheet is in good shape. Debt is lower YoY and there are no significant red flags on the surface Further, YZJ share price and profitability ratios has been outperforming most pure shipbuilder plays due to their position as China’s top shipbuilder leading to a higher than average contract win with manageable margins.

With China lowering its forecast for multiple macroeconomic indicator together with poorer actual results, we expect contract wins to dwindle in FY19 and ahead.

Baltic Dry Index is at lows and has been suppressed for a prolonged period, New vessel orders tend to come in only when the BDI maintains a healthy level of at least 2k for an adequate period. The all time high was in May2008 of 11.7k points whilst the low was in Feb2016 of 290 points.

The other reason YZJ’s share price has been outperforming is due to its net-cash(inclusive of investments) balance sheet of approximately S$0.80. The investments generate ~10% gross returns (pre-impairment).

Net Impairment loss of RMB212M in FY18 is lower than FY17’s RMB296M and is approximately 1.5%. In our opinion, this is a very low % and we fully expect this % to increase significantly as China economy slows.

Major Risk Factors (Investment / Loans portfolio) + (Currency Risk)

[Investments / Loans Portfolio] - 30% of gross profit

Looking at YZJ’s FY17 annual report, we are able to obtain a glimpse into the industries that YZJ provides funding to and the collateral. The 2 largest industries are Manufacturing which will be the first to be affected when an economy slows down and services which is likely to be collateralised by shares as they are not asset heavy. We will not elaborate into the risks associated with each collateral type but however will remind our readers that the value of collateral decreases the most when the Borrower needs them the most.

Interest / Investment incomes contributes a major 30% of total gross profit. We deem this business as risky as any collateral value can be eroded in a quick fashion in a major risk off event in Mainland China.

As at 31 December 2018, other investment at amortised costs had increased to RMB14.81 billion from RMB11.98 billion at end of FY2017, and the impairment provision for other investment at amortised costs stood at RMB1,546 million as at the end of FY2018.

As below is a look at the recent economic data for China showing a major slowdown.

Caixin Services PMI

China Manufacturing PMI

Currency Risk due to major US Dollar devaluation on deterorating US economic data

Currency risk is a major factor that could affect earnings for the company. As show in the chart below, a 7% move lower in the US Dollar would equates to a 30% cut to net profit taking reference to group 2018 net profits.

The US Federal Reserve have announced plans to stop their quantative tighening to their balance sheet by 2019, while rate hikes are off the table.

Given the recent deteriorating economic data in the US, and our on going macro call for Fed rate cutes in 2019 / 2020, a major devaluation of the US dollar could lead to a negative eps in 2020 which would severly impact the share price.

Economic data in Europe have also suffered after a major slow down in China. The ECB this week have downgraded 2019/2020 growth forecast which impacted the euro this week.

The company is in a bad position in an event of currency wars from a major risk off event as financial markets have been on a fragile state since Q4 2018.

Conclusion

We expect both the shipbuilding and funds segment to significantly underperform as a consequence of the impending economic downturn. Weakening USD against the RMB is also a major factor which would pose a double whammy to the company in 2019/2020.

We announce a short on YZJ at the close of trading 8/3/19 at S$1.39 with a 18 months target of S$0.50.

Any content on this blog should not be relied upon as advice or construed as providing recommendations of any kind.

Comments