Trade War, Real War? Week review + Scenario analysis

- Apr 15, 2018

- 6 min read

A very exciting week with regards to Macroeconomic developments which have allowed us to take on two new positions on the week. These new positions are Long Gold against US dollar(11/4/18), and Long US Dollar against the Russian Ruble(9/4/18). We had warned of rising tensions between the US and Russia early Monday on our Facebook page, only to have US/UK/France strike Syria with missiles and set themselves on upcoming conflict with Russia late Friday this week.

Our short Russian Ruble trade have gained 4% as of Friday close, while Long Gold position has been flat. We expect both positions to gap up in our favor on Monday morning due to Syrian tensions and further developments after Friday market close.

We do post immediately on our Facebook page after trade initiation, along side a short brief. Readers who are keen to keep track of the latest trade recommendations or breaking views could follow the Facebook page at the link below.

If there is interest to read up on previous weekly posts, head over to our website homepage as below.

We maintain our view of selling bounces on global equity market indices as risk from our first post past week and developments / price action this week had us maintain our sell call for the S&P500 and Nasdaq100.

Trade thought analysis and predictions to Macro Developments.

1) Russian Sanctions

The United States imposed sanctions on 24 Russian oligarchs and officials on 6/4/18 for worldwide malign activity by Russia. This sanctions had by far the most impact on Russian business, with the broad MOEX Russian Index down 10% on 9/4/18, along side a sell off on the Russian Ruble. These sanctions on the individuals have broad impact on Russia as the business those Russian oligarchs control are no longer able to deal in US dollars as no US Bank is able to clear their trades. Individuals or corporations who are non US based risk secondary sanctions for dealings with those sanctioned by the USA.

Many Russian companies are active in the US and EU debt markets, in which many global investors are thus hurt by this sanction move, having to liquidate both equity and debt they had invested on Russian companies by selling into a bid-less market this week or risk secondary sanctions. We expect some form of spillover to the broader market eventually through either a rating cut on Russian Debt, or outflows from various capital markets due to the one of sudden devaluation on Russian assets last week.

It is interesting to note how timely these sanctions were imposed by the USA, while the media have noted of the Syrian chemical attacks reported by "White Helmets" just the next day 7/4/18 in north-western Douma Syria, which make us think there is something bigger going on behind the scenes (USA/UK Taunting Russia to WW3). More analysis on this in the next section of Syrian tensions.

It was reported by Reuters over the weekend that the poison used against Russian spy Skripal Lavrov was developed in US/UK Labs and never in Russia, which make us think there is really much more going on behind the scenes on the Allied coordinated response in Syria.

2) Syrian Tensions (Russia vs USA)

Most of this week headlines are dominated by the tensions in Syria with the US rallying their allies for a Strike in Syria which which a coordinated response finally coming to fruition late Friday 13/4/18.

The strike was against the Syrian Regime chemical warfare actions and supplies. The use of chemical weapons has been denied by both Syria and Russia. It is interesting to note that the "White Helmet" NGO is backed by the USA and UK for humanitarian support in Syria. There has also been reports since 2017 by MIT Emeritus of Science Professor Theodore A. Postol of staged chemical attacks in Syria.

The close timing of both Russian sanctions and White Helmets report of another chemical attack in Syria had us at wondering if the US and UK is taunting Russia on a possible battle in the Middle East, with the USA leading the first round of strikes in the name of destroying chemical weapons facilities in Syria. Russia has warned many times throughout the week that they would strike US destroyers at the Straits of Syria in the event of an strike that could harm Russian personnel.

With the US/UK/France making the first move, we are keen to see how tough guy Vladimir Putin reacts. The Russian Embassy in the USA had issued a statement on Facebook shortly after the strikes, warning of a pre-designed scenario being implemented and that US actions will not be left without consequences.

A couple of possible actions that can be taken by the Russians in retaliation.

a)Sanctions over US firms and people. Russia's VSMPO-AVISMA is the world's largest titanium producer and the main supplier to Boeing. Sanctions would cripple Boeing manufacturing capability and lead to further global trade war which is already on going with China. Sanctions as an option is almost a 100% certainty some point in the next few weeks, which reinforce our bear case on US Equities, along side a weaker Russian Ruble.

b)A show of military strength will have to be done either through non-uniformed disguise of Russian Armed Forces, or through a layered disguise in the name of the Syrian Army to strike US Destroyers currently holding at the Straits of Syria. We look at this military option as a black swan event which could lead to months long campaign for the USA in Syria. It was reported that General Mattis is very wary of a retaliation from Russia after the warnings but Trump had given the go ahead anyway in a show of strength of who is your boss!

c)A weaker military response would be for Russia and Syria to line up their naval defenses with regular taunting against the USA off the straits of Syria. Russia would be more involved in the middle east while seeking cooperation from their ally Iran in anticipation for any further strikes from the USA which could lead to a full blown war eventually.

We maintain our negative view on equity markets basis the possible scenarios above which all calls for caution due to economic fallout between the US and Russia.

3) China-USA Trade War

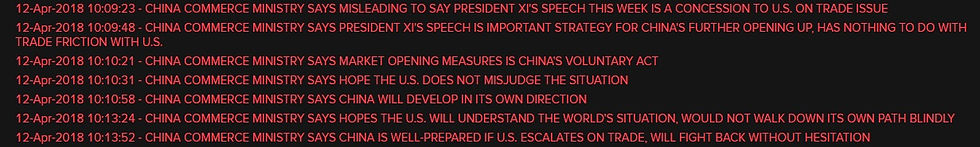

The China-USA Trade dispute has been least of the concerns this week with the market taking Chinese President Xi speech on Tuesday on opening up trade as a position indication of no trade war. However, we think the market is wrong to think so as the Chinese Commerce Ministry have maintained their position that there has been no discussions / negotiations on this front.

With the USA due to announce their 100B new Tariff package to China as soon as next week, we are very excited to see renewed kids war on the wires soon. The Chinese have tested the waters on possible Yuan devaluation this week, while still putting the nuclear option of selling USTs on the back burner.

We take this bounce in the markets on 10th and 11th April as a chance to add to reduce longs or add to shorts as it is a matter of time this bounce fail on new trade war headlines.

4) Early US Earnings report + 13/4/18 S&P500 price action

Citibank , Wells Fargo and JP Morgan all reported better then expected earnings on Friday 13/4/18. This had the S&P500 opening at highs of 2680, but was unable to hold on to any gains throughout the day and ended down at 2656. This was on the back of Trump tweet that he might not strike Syria at all earlier that day. I could not recall a time in the past 8 quarterly earning season where by a early earnings calendar positive beat report by major banks saw the S&P500 not holding on to its gains.

We take this negative price action as a victory for bears this week as we managed to close just under the previous bounce highs of the 2670 levels.

We will now test the uptrend line from early April. A break would lead us to test the lows again, with the S&P500 200MA now higher at 2599. We acknowledge that it is crucial to Bears that the S&P500 test the 200MA again next week or risk further short covering.

A break of the 200MA levels followed by 2550 lows would lead to a downward wave 3 under the Elliot wave studies targeting the 2200 levels. Leveraged margin debt is at the highest on record, we repeat our call for a lack of buyers and liquidity in the market if levels are broken.

It has been a rather painful week for Bears as a test of the 2680 levels early Friday, had us risking negative price action to our trading plan which was based on a lower highs chart since Feb2018. The Friday close is a victory for now as the price action remains in our favor as long as 2670 is capped.

Good luck to all.

The Bad Bear

Comments